Binance Stocks : The World of Digital Currency Investment

Binance, one of the world's largest cryptocurrency exchanges, has expanded its offerings to include Binance Stocks, allowing users to invest in traditional stocks using digital currency. This innovative platform provides investors with access to a diverse range of stocks, including tech giants, blue-chip companies, and emerging startups, all within the realm of digital currency. In this article, we'll delve into the world of Binance Stocks and explore how investors can leverage digital currency to diversify their investment portfolios.

- Understanding Binance Stocks: Binance Stocks enables

users to trade fractional stocks using digital currency, offering a

convenient and accessible way to invest in traditional financial markets.

- Accessibility and Convenience: By integrating

traditional stock trading with digital currency, Binance Stocks provides

investors with seamless access to global markets, 24/7 trading, and

instant settlement.

- Fractional Ownership: Binance Stocks allows investors

to purchase fractional shares of stocks, making it possible to invest in

high-priced stocks with smaller amounts of digital currency.

- Diversification Opportunities: Investors can diversify

their portfolios by gaining exposure to a wide range of stocks across

different sectors and industries, all within the Binance platform.

- Seamless Integration: Binance Stocks is seamlessly

integrated into the Binance ecosystem, allowing users to manage their

digital currency and traditional stock investments from a single platform.

- Regulatory Compliance: Binance Stocks operates in

compliance with regulatory requirements, ensuring a secure and compliant

trading environment for investors.

- Trading Flexibility: With Binance Stocks, investors

have the flexibility to trade stocks using various digital currencies,

including Bitcoin (BTC), Ethereum (ETH), and Binance Coin (BNB).

- Risk Management: Investors can use Binance Stocks to

hedge against volatility in the cryptocurrency market by diversifying

their holdings with traditional stocks.

- Transparent Pricing: Binance Stocks offers transparent

pricing and low fees, allowing investors to maximize their returns without

being burdened by excessive trading costs.

- Educational Resources: Binance provides educational

resources and tools to help investors learn about stock trading, market

analysis, and investment strategies.

- Research and Analysis: Investors can access

comprehensive research and analysis tools within the Binance platform to

make informed investment decisions.

- Security Measures: Binance employs robust security

measures, including encryption, multi-factor authentication, and cold

storage, to protect investors' digital assets and personal information.

- Regulatory Compliance: Binance Stocks adheres to

regulatory standards and compliance requirements in the jurisdictions

where it operates, ensuring a safe and transparent trading environment for

investors.

- Global Market Access: With Binance Stocks, investors

can access global stock markets and trade stocks listed on major exchanges

around the world.

- Liquidity and Trading Volume: Binance Stocks benefits

from Binance's large user base and high trading volume, providing

liquidity and price stability for investors.

- Portfolio Management Tools: Binance offers portfolio

management tools and features to help investors track their stock

holdings, monitor performance, and manage risk effectively.

- Customer Support: Binance provides responsive customer

support services to assist investors with any questions, concerns, or

technical issues they may encounter while using the platform.

- Regulatory Compliance: Binance Stocks operates in

compliance with regulatory requirements in the jurisdictions where it

operates, ensuring a secure and compliant trading environment for

investors.

- Market Volatility: Investors should be aware that both

the cryptocurrency and stock markets can be volatile, and prices may

fluctuate significantly in a short period.

- Risk Management Strategies: To mitigate risk, investors

should diversify their portfolios, conduct thorough research, and consider

their investment goals and risk tolerance before trading on Binance

Stocks.

- Long-Term Investment Potential: Despite short-term

fluctuations, many investors view digital currency and traditional stocks

as long-term investment opportunities with the potential for significant

returns over time.

- Integration of Traditional and Digital Finance: Binance

Stocks represents a groundbreaking integration of traditional finance and

digital currency, bridging the gap between these two worlds and providing

investors with new opportunities for portfolio diversification and wealth

accumulation.

- Regulatory Considerations: As with any investment

platform, it's essential for investors to understand the regulatory

landscape governing Binance Stocks in their respective jurisdictions.

Compliance with regulations ensures investor protection and maintains the

integrity of the financial markets.

- Market Analysis and Due Diligence: Before investing in

any stock, whether traditional or digital, thorough market analysis and

due diligence are paramount. Investors should research the fundamentals of

the companies they're interested in, analyze financial statements,

evaluate industry trends, and consider macroeconomic factors that may

impact stock prices.

- Risk Management Strategies: Effective risk management

is critical when trading on Binance Stocks or any other investment

platform. Investors should employ diversification strategies, set

stop-loss orders to limit potential losses, and allocate only a portion of

their portfolio to higher-risk assets such as digital currency.

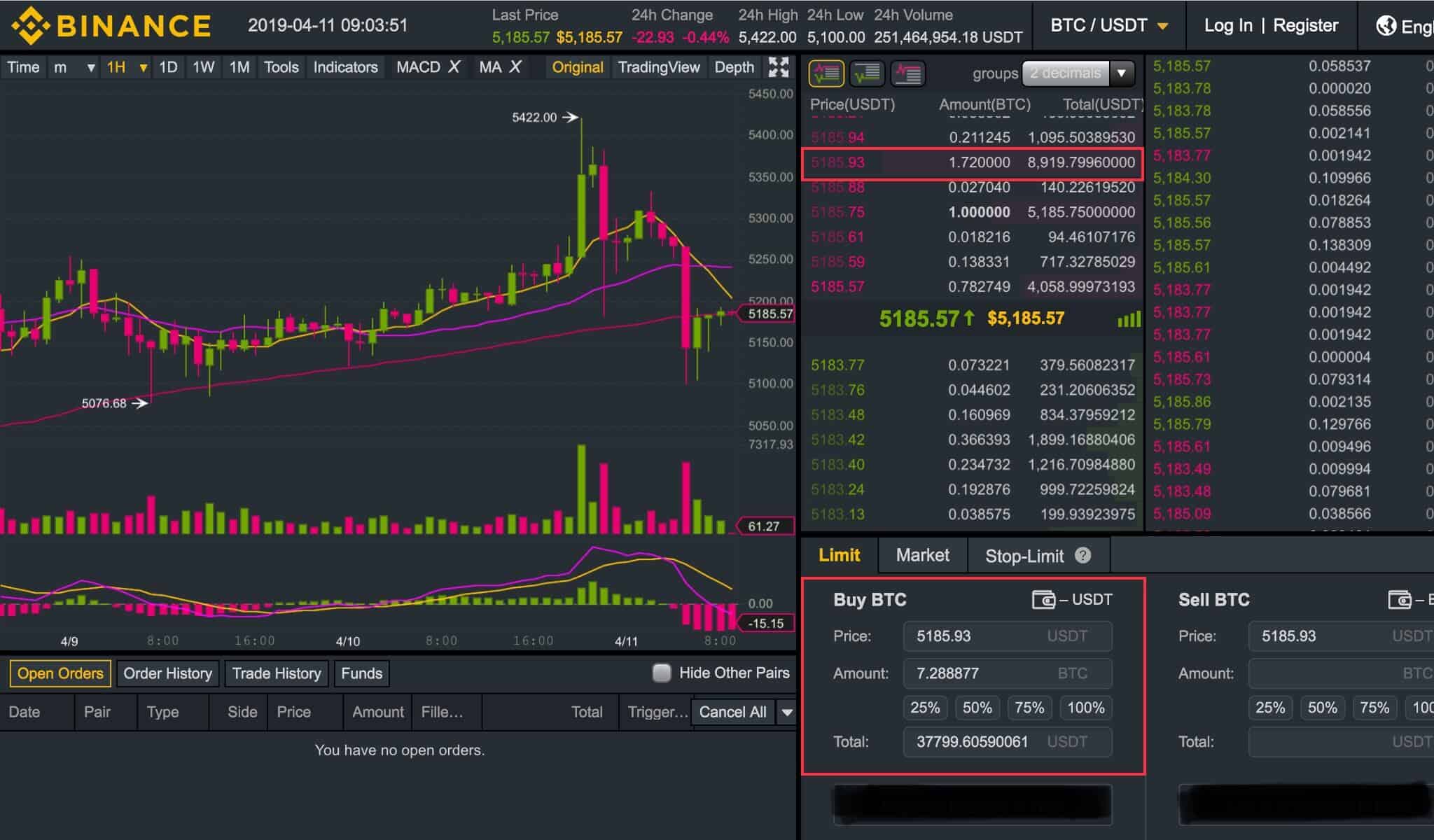

- Technical Analysis Tools: Binance provides investors

with access to a wide range of technical analysis tools and indicators to

help them make informed trading decisions. These tools enable investors to

analyze price trends, identify support and resistance levels, and spot

potential buying or selling opportunities in the market.

- Fundamental Analysis: In addition to technical

analysis, fundamental analysis plays a crucial role in evaluating the

intrinsic value of stocks. Investors should assess factors such as earnings

growth, revenue potential, competitive positioning, and management quality

when determining the long-term prospects of a company.

- Investor Education: Binance is committed to educating

investors about the complexities of stock trading, digital currency

investing, and risk management strategies. Through educational resources,

webinars, tutorials, and seminars, Binance empowers investors to make

informed decisions and navigate the financial markets with confidence.

- Economic and Geopolitical Events: Investors should stay

informed about economic indicators, geopolitical events, and regulatory

developments that may impact stock prices and digital currency markets.

Events such as interest rate decisions, geopolitical tensions, and

regulatory announcements can have significant implications for market

sentiment and asset valuations.

0 Comments